Balance Sheet Analysis – Building Owner Equity

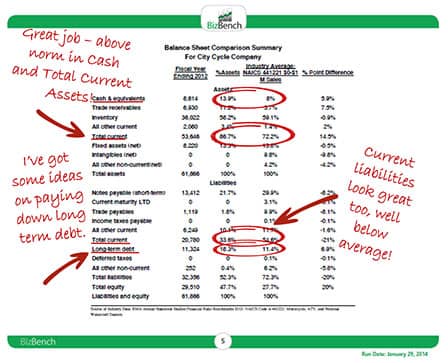

The Balance Sheet Comparison Summary charts the actual dollar amounts for each Balance Sheet category, converts it into a percent of total assets and benchmarks the percentage against the percentage of total assets for the industry standard for both Asset and Liability categories. This normalizes the report as actual amounts would vary more than the percentages of total assets.